- New York Republicans’ Economic Excitement Slows But Still Bullish on Trump Economy; Democrats Remain Down 22 Points Since Election, 19 Points Below Rep’s & Well Below Breakeven

- Gas Worries Still Persistent, 47% Feeling Pain at Pump; Food Concerns Dropping Slightly; Buying Plans Remain Robust Despite Pending Tariffs

Press Release Summary Trends Buying Plans Gas and Food

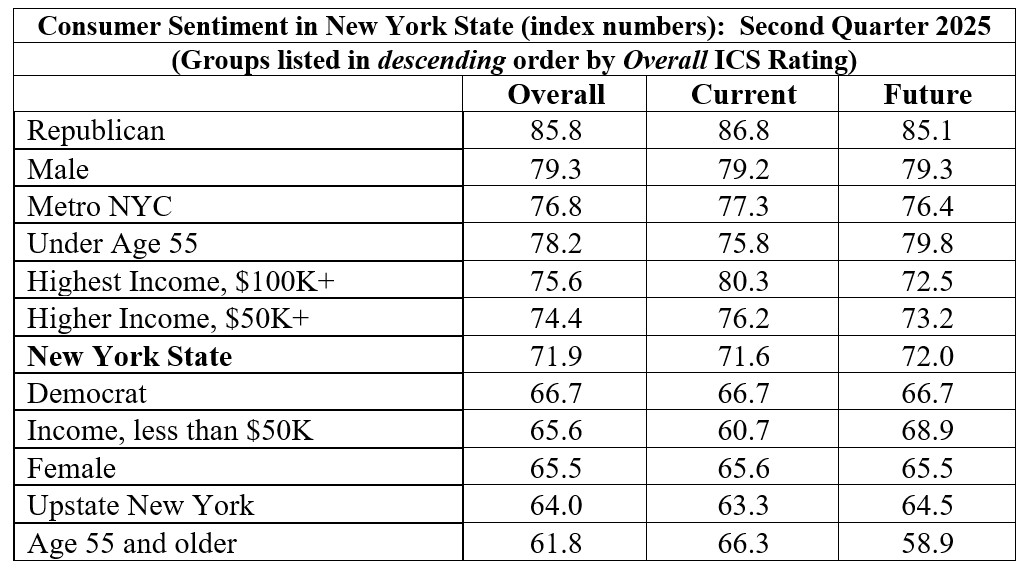

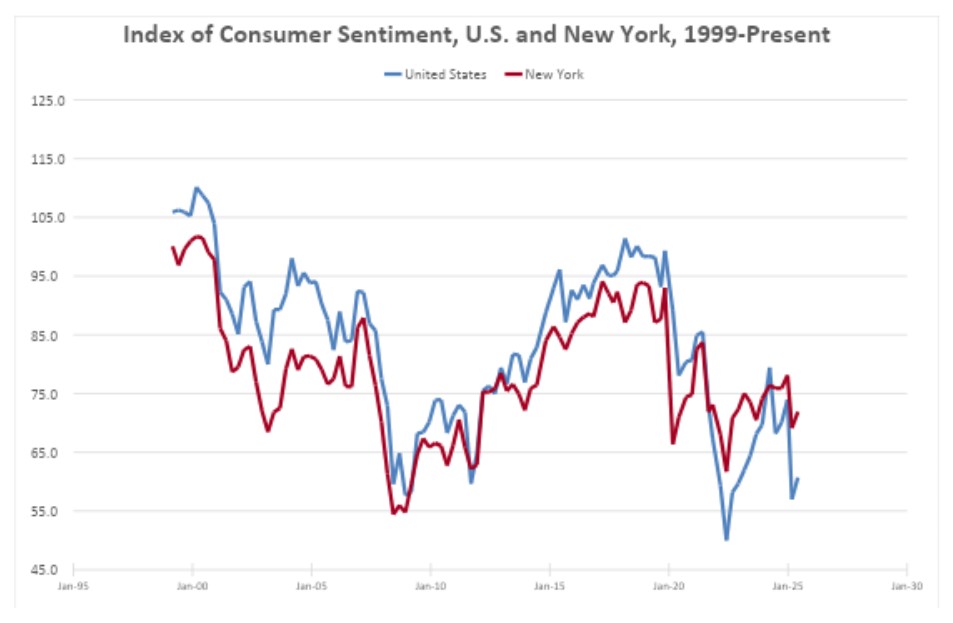

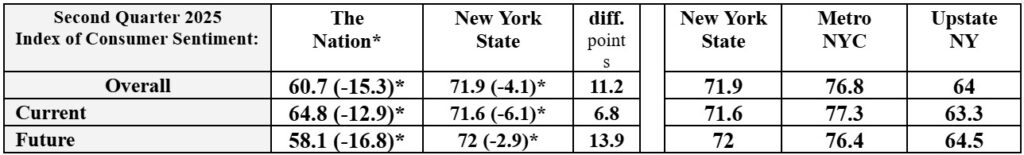

Loudonville, NY – The New York State Index of Consumer Sentiment now stands at 71.9 up 2.8 points from the last measurement in the first quarter of 2025 according to the latest poll by the Siena College Research Institute (SCRI). New York’s overall Index of Consumer Sentiment is 11.2 points above the national* index of 60.7 following a 3.7 point national increase. New York’s current index increased 4.9 points to 71.6 and the future index increased 1.4 points resulting in New York’s measure of future expectations moving from 70.6 last quarter to 72.0 today. Overall consumer sentiment remains higher in New York than across the nation. For the second consecutive quarter, the overall index is below the breakeven point of balanced optimism and pessimism.

“After a whirlwind of on-again, off-again tariff news, confidence of NY’s consumers is gradually recovering after a sharp nine-point decline in the first quarter of 2025. In both New York and across the nation, sentiment is improving—but it still remains below the threshold where optimism outweighs pessimism. While current confidence in New York rose by nearly five points, the national figure increased by just one. Conversely, New York’s future outlook rose 1.4 points, while the national future score jumped more than five and a half points since last quarter,” according to Travis Brodbeck, SCRI’s Associate Director of Data Management. “For the third consecutive quarter, Republicans in New York continue to be more optimistic about the current and future economic compared to their Democratic counterparts. The typically optimistic outlook for the future economy has significantly diminished. Historically, consumers have been significantly more optimistic about the future economy than the present, with future expectations averaging 8 points higher since 2020, however this quarter the gap closed and future confidence is only 0.4 points higher than current, the lowest gap recorded in the past five years. This is a notable shift – consumers are now barely more optimistic about the future economy than they are about the present.”

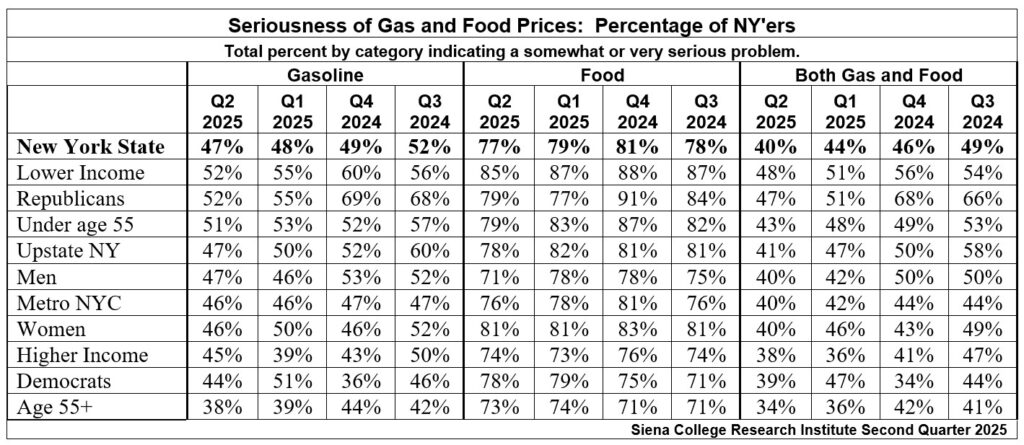

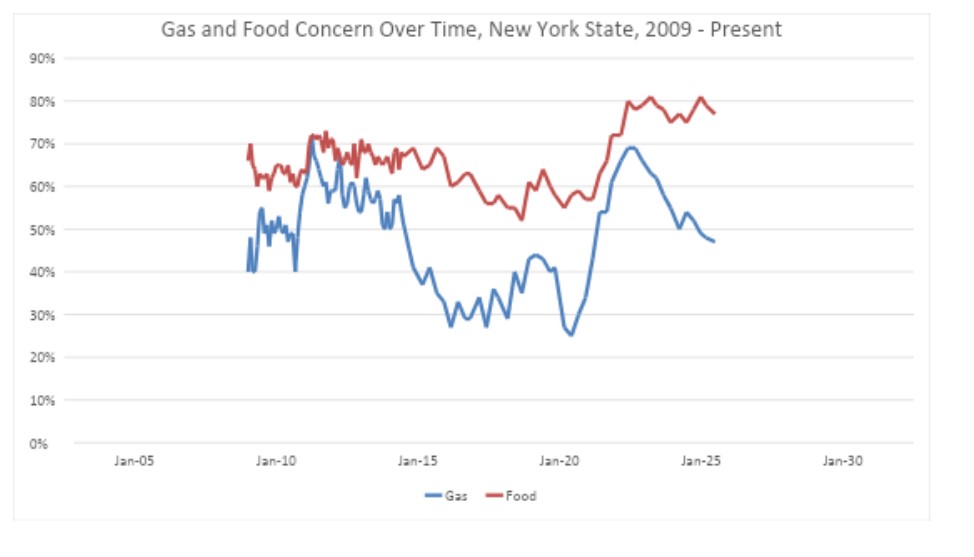

Buying plans in the second quarter are mixed. Since the previous quarter’s measurement, buying plans for consumer electronics increased the greatest, rising 2.0 points to 47.0% (from 45.0%) and home buying plans also increased to 10.9% (from 9.7%). Vehicle buying plans declined to 17.8% (from 20.9%) and major home improvement plans edged down to 23.6% (from 24.3%). Buying plans for furniture remained unchanged from the previous quarter at 30.2%. Forty-seven percent (1% decrease from last quarter and the lowest since March 2021) of all New Yorkers say that current gasoline prices are having a very serious or somewhat serious impact on their financial condition. Seventy-seven percent (down from 79% last quarter) of state residents indicate that the amount of money they spend on groceries is having either a very serious or somewhat serious impact on their finances.

“As the President’s agenda moves through Congress and trade deals are being actively negotiated, consumers buying behaviors are mostly unchanged,” Brodbeck said. “With so much change being discussed in the macroeconomy, consumers may be taking a wait and see approach when making purchasing decisions. While some big purchases are down like purchasing a vehicle or a major home improvement, more consumers are planning to purchase a home this quarter than the previous. Despite uncertainty around tariffs on electronics, the largest increase in anticipated purchasing this quarter was for buying consumer electronics.”

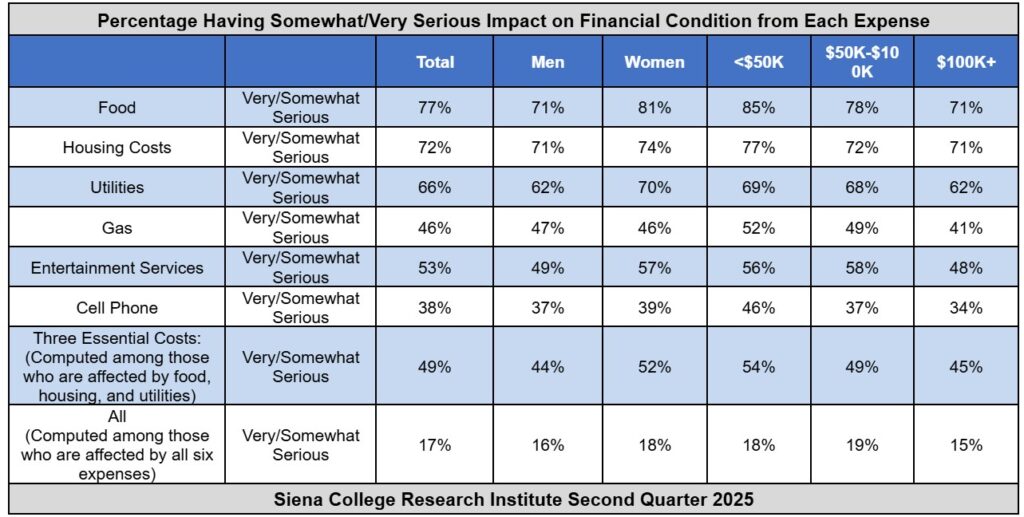

New Yorkers continue to feel the weight of essential monthly expenses. This quarter, 72% say housing costs are having a serious impact on their financial situation, up slightly from 69% last quarter. Utility costs are at 66% (down from 67% last quarter), and 53% say streaming and entertainment services are a financial strain (up from 51% last quarter). Reports of cell phone costs being a very or somewhat serious financial burden increased to 38% (from 36%). Nearly half, 49%, of New Yorkers say they are seriously impacted by all three essentials—housing, utilities, and food. Nearly one in five, 17%, report that all six key monthly expenses—food, gas, housing, utilities, entertainment, and cell phones—are weighing heavily on their finances.

This Siena College Poll was conducted June 25 – July 2, 2025, among 921 New York State Residents. Of the 921 respondents, 516 were contacted through a dual frame (landline and cell phone) mode (237 completed via text to web) and 405 respondents were drawn from a proprietary online panel (Cint). Of the 237 respondents who completed the survey via text to web, 114 completed them on CloudResearch’s Engage software platform and 123 were collected on the Voxco survey software. Telephone calls were conducted in English and respondent sampling was initiated by asking for the youngest person in the household. Telephone sampling was conducted via a stratified dual frame probability sample of landline and cell phone telephone numbers weighted to reflect known population patterns. The landline telephone sample was obtained from ASDE and the cell phone sample was obtained from Marketing Systems Group (MSG). Interviews conducted online are excluded from the sample and final analysis if they fail any data quality attention check question. Duplicate responses are identified by their response ID and removed from the sample. Three questions were asked of online respondents, including a honey-pot question to catch bots and two questions that ask respondents to follow explicit directions. The proprietary panel also incorporates measures that safeguard against automated bot attacks, deduplication issues, fraudulent VPN usage, and suspicious IP addresses. Coding of open-ended responses was done by a single human coder. Data from collection modes was weighted to balance sample demographics to match estimates for New York State’s population using data from the Census Bureau’s 2023 U.S. American Community Survey (ACS), on age, region, race/ethnicity, and gender to ensure representativeness. The sample was also weighted to match current patterns of party registration using data from the New York State Board of Elections. It has an overall margin of error of +/- 3.6 percentage points including the design effects resulting from weighting. Sampling error is only one of many potential sources of error and there may be other unmeasured error in this or any other public opinion poll. The Siena College Research Institute, directed by Donald Levy, Ph.D., conducts political, economic, social, and cultural research primarily in NYS. SCRI, an independent, non-partisan research institute, subscribes to the American Association of Public Opinion Research Code of Professional Ethics and Practices.For survey cross-tabs: www.Siena.edu/SCRI/.

Appendices