- 61% Describe Their Members as ‘Pessimistic’; 2/3rds Say at Least ‘Somewhat Likely’ that U.S. Recession Will End with a Year

- Chamber Leaders Give their State Govt. Higher Marks than Feds on Improving Business Climate; Satisfied with State Management of Pandemic; Not with D.C.’s

Loudonville, NY. Ninety percent of chamber of commerce executives from across the country say that business conditions have worsened over the last six months according to a new online survey of 796 chamber of commerce leaders conducted by the Siena College Research Institute (SCRI). Fifty-five percent think conditions will improve between today and the end of 2021 while 32 percent continue to anticipate the economy worsening in their state and local area. Sixty-one percent describe their members as somewhat or very pessimistic about their businesses’ current prospects. While 23 percent say it is very likely or almost certain that the U.S. economy will come out of recession by the end of 2021, 43 percent say it is somewhat likely, and 34 percent think it not very, or not at all likely that the recession will end.

Forty-four percent of chamber leaders say their state government is doing an excellent or good job creating a business climate in which companies can succeed but only 28 percent give the federal government the same grade. A majority, 59 percent, are confident in the ability of their state government to improve the business climate but fewer, 48 percent, have the same confidence in the federal government. While two-thirds are satisfied with their state’s management of the COVID-19 pandemic, only 38 percent are satisfied with the federal government’s management of the pandemic.

“Chamber leaders are in the trenches with their members. Their fingers are on the pulse and over the last six months, that pulse is weak,” said Don Levy, SCRI’s Director. “Most see pessimistic looks on the faces of local business people and only just over half predict a better year ahead.”

“Unfortunately, only 23 percent think it either very likely or almost certain that the U.S. economy will come out of recession by the end of 2021. Leaders in the Midwest and the South are more optimistic than those in either the Northeast or the West,” Levy said.

“Chamber leaders give higher grades to their state government than they do to the federal government on creating a business climate in which companies can succeed. Leaders from the South grade their state governments far higher than leaders from other regions. While leaders from the South give the federal government a better rating than those from other regions, when it comes to managing the COVID-19 pandemic, a majority from every region is either not very or not at all satisfied with the federal response,” Levy said.

“Most chamber leaders from every region are satisfied with their state government’s response to the pandemic with leaders from the Northeast being most satisfied at a rate of over 80 percent,” Levy said.

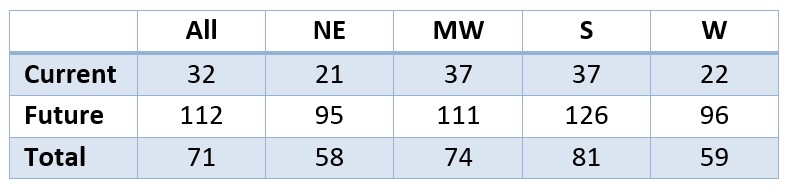

The Index of Chamber Confidence looks at both the current economic conditions in the executives’ state and local area and looks ahead to the future expectations for their state and local area. The confidence index computed using four questions, stands at 71. The figure is far below the breakeven of 100 with possible score ranging from 0 to 200. The current outlook scores are quite low while the future expectations score barely above the breakeven of 100. The differences among regions are notable with only the Midwest and South exceeding the midpoint/breakeven point on future expectations.

*Region Definitions are:

Northeast- New England (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont) Mid-Atlantic (New Jersey, New York, and Pennsylvania)

Midwest- East North Central (Illinois, Indiana, Michigan, Ohio, and Wisconsin) West North Central (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota)

South- South Atlantic (Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, District of Columbia, and West Virginia) East South Central (Alabama, Kentucky, Mississippi, and Tennessee) West South Central (Arkansas, Louisiana, Oklahoma, and Texas)

West- Mountain (Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, and Wyoming) Pacific (Alaska, California, Hawaii, Oregon, and Washington)

The survey was conducted with assistance from Chris Mead. He is a former senior vice president of the Association of Chamber of Commerce Executives (ACCE), where he served for 16 years, and previously spent 20 years in economic development writing, consulting, and association management. He is the author of “Magicians of Main Street: America and its Chambers of Commerce, 1768-1945,” and manages a consultancy on chambers. Chris holds a B.A. degree in English from Oberlin College and an MBA from Stanford University. He can be reached at chris@magiciansofmainstreet.com or (703) 864-2247.

This Siena College Poll was conducted July 31- August 14, 2020 using a listed sample of chamber executives. The survey was sent to over 3,300 chamber executives across the US and had 796 responses. The Siena College Research Institute, directed by Donald Levy, Ph.D., conducts political, economic, social and cultural research primarily in New York State. SCRI, an independent, non-partisan research institute, subscribes to the American Association of Public Opinion Research Code of Professional Ethics and Practices. For more information, call Don Levy at (518) 783-2901 or dlevy@siena.edu. For survey cross-tabs and frequencies: www.Siena.edu/SCRI