- By 49-20% NY’ers’ Income has Increased Rather than Decreased; 19% are ‘Getting Ahead’, 47% ‘Staying Even’; By 51-24% Optimistic Looking to Financial Future

- Only 47% of NY Households Have an Actual Monthly Budget; 27% Carry Credit Card Balances; 55% Have a Savings Account with at least $2,000 for Emergencies, 43% Don’t

- Retirement: 34% Have Neither a 401K Nor a Traditional Pension; 69% of Retirees Financially Confident in Maintaining Quality of Life; Of those Not Yet Retired, 54% Confident, 42% Worry Will Not Have Enough Money

Loudonville, NY – Overwhelming majorities of New Yorkers say they are spending more today than they were two years ago on groceries, housing and transportation according to a new survey of New York residents released today from the Siena College Research Institute (SCRI). By 79-14% after considering both their income and expenses, they say that inflation has had a negative, not positive, impact on their finances, and 70% say that inflation is still a big problem. Overall, when it comes to money, 33% of New Yorkers say that they are falling behind.

Forty-nine percent say that their total household income has increased over the last two years but 20% say their income has decreased while 30% say it has remained the same. Nineteen percent say that they are ‘getting ahead’ when it comes to money but nearly half, 47% describe their financial situation as ‘staying even.’ Asked to look to the future and think about their finances, 51% are optimistic (18% very, 33% somewhat), 23% are neither optimistic nor pessimistic and 24% are pessimistic (16% somewhat, 8% very).

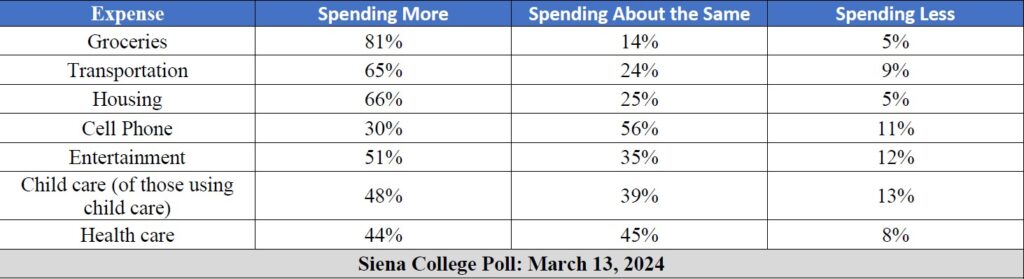

“We hear it again and again, things just cost more,” said Don Levy, SCRI’s Director. “Eighty-one percent are paying more for groceries, 66% for housing and 65% for transportation compared to two years ago. Just over half are paying more for entertainment services like the internet, and nearly half have to pony up more for health care costs. With just half of New Yorkers saying that their income increased over the same period, it’s no surprise that 70% insist inflation remains a big problem and that one third of all New Yorkers as well as half of those earning $50K or less, say that they are falling behind.”

Forty-seven percent of New Yorkers say that they and their household have a monthly budget, either written, on their computer or through an app that they use to keep track of income and expenses. A small majority, 52%, say that they do not keep a monthly budget.

Seventy-two percent use a credit card during the month to make routine household purchases, 69% use a debit card and 25% continue to write checks. Of those that use credit cards, 38% or 27% of all New Yorkers, do not pay the total balance on their credit card but rather carry a balance on their card or cards.

“Some New Yorkers do feel as though they are getting ahead financially. Half of all residents, 61% of those earning $100K or more, have seen their incomes increase, and despite increasing monthly costs, one in five of all New Yorkers and a third of higher earners say that they are getting ahead. But, with more than a quarter of New Yorkers carrying high interest credit card debt from one month to the next, 18% saying they or a household member has had a debt placed into collections recently and 43% saying that they do not have $2000 in savings for a rainy day, the stress on many residents is apparent,” Levy said.

Among retired New Yorkers, 69% are either very (29%) or somewhat (40%) confident that they will have enough money to maintain their quality of life in retirement while 26% are either not very (15%) or not at all (11%) confident. Among those not yet retired, 54% are either very (21%) or somewhat (33%) confident that they will be able to retire and have enough money to maintain their quality of life throughout retirement while 42% are either not very (25%) or not at all (17%) confident.

Thirty-seven percent have a traditional pension plan through an employer that provides a guaranteed monthly income while 57% have a personal retirement account like a 401K or an IRA. Thirty-four percent of New Yorkers have neither a traditional pension nor a personal retirement account. While 55% of those without retirement accounts are under the age of 45, a third are between 45-64 years of age and 10% are 65 years of age or older. Only 22% of those without a retirement account or pension, have a rainy day fund of $2000 or more, 48% say they are falling behind financially and of those not yet retired, a majority are not confident in their ability to maintain their quality of life in retirement.

“Despite inflation and its toll of higher monthly costs, a majority of New Yorkers remain optimistic about their future financial picture,” Levy said. “While I’m a pollster and not a financial planner, these numbers tell me that more probably ought to have a written budget, and as soon as possible, start saving for retirement as optimism alone may not pay these increasing monthly bills.”

Percent of New Yorkers spending more, same or less on monthly expenses compared to two years ago

This Siena College Poll was conducted February 20 – March 5, 2024 by random telephone calls to 401 New York adults via landline and cell phones and 400 responses drawn from a proprietary online panel of New Yorkers. Telephone calls were conducted in English and respondent sampling was initiated by asking for the youngest person in the household. Telephone sampling was conducted via a stratified dual frame probability sample of landline and cell phone telephone numbers weighted to reflect known population patterns. The landline telephone sample was obtained from ASDE and the cell phone sample was obtained from MSG. Data from collection modes was weighted to balance sample demographics to match estimates for New York State’s population using data from the Census Bureau’s 2023 U.S. American Community Survey (ACS), on age, region, race/ethnicity, education, and gender to ensure representativeness. The sample was also weighted to match current patterns of party registration using data from the New York State Board of Elections. The overall results has an overall margin of error of +/- 3.8 percentage points including the design effects resulting from weighting. Sampling error is only one of many potential sources of error and there may be other unmeasured error in this or any other public opinion poll. The Siena College Research Institute, directed by Donald Levy, Ph.D., conducts political, economic, social and cultural research primarily in NYS. SCRI, an independent, non-partisan research institute, subscribes to the American Association of Public Opinion Research Code of Professional Ethics and Practices. For more information or comments, please call Dr. Don Levy at 518-783-2901. Survey cross-tabulations can be found at www.siena.edu/scri/cci.