First Niagara

Fourth Annual Survey of Pennsylvania Business Leaders

1/23/13

Summary of Findings

Summary

The Fourth Annual First Niagara Survey of Pennsylvania Business Leaders conducted by the Siena College Research Institute (SRI) shows that CEO confidence has fallen and is now significantly more negative than positive for the first time in four years. After recovering from the depths of the recession of 2007-8, and expressing growing optimism for several years, many CEO’s are now frustrated with the economy, and today anticipate declining revenue growth and lessened profitability in 2013. A majority of the most confident (about a quarter) predicts an uptick this year in revenues and profits but even among these most optimistic business leaders, fewer than half plan to hire this year. Most CEO’s are braced for a very difficult year ahead. An overwhelming percentage lack confidence in the ability of Pennsylvania’s political leaders to help in creating a business climate in which they can succeed. Still, with polls showing heightened consumer sentiment and willingness to spend in the Keystone State, CEO’s who have cut all that can be cut may find much needed relief in the renewed activity consumers promise. Commerce will take place in 2013 and companies that innovatively meet consumer and client needs and demand will benefit from forecasted revitalized but cautious consumer spending.

Business Leader Confidence

The overall Index of Pennsylvania Business Leaders fell sharply to 88.9 down 23.2 points or nearly 21 percent from last year and is now the lowest in the four year history of this study. The Index is now well below the 100 mark, at which equal percentages of CEO’s are both optimistic and pessimistic about economic conditions in their industry and across the state. The current index component that assesses business conditions today as compared to six months earlier is now 80.2 down from 104.7 last year and 2 points below 2009’s previous low. The future component that measures expectations for the coming year is 97.6 down from 119.5 a year ago. Thirty-two percent, down from 42 percent a year ago, of CEO’s of private, for-profit companies with sales between $5 million and $200 million in Philadelphia, Pittsburgh, as well as in Allentown, Altoona, Erie, Harrisburg, Lancaster, Reading, Scranton and York expect better economic conditions in Pennsylvania next year. Thirty-two percent, up from only 20 percent a year ago, anticipate worsening conditions.

This survey reports data from 715 corporate leaders drawn from Service (27%), Manufacturing (22%), Engineering/Construction (15%), Retail (13%), Wholesale/Distribution (13%), Financial (6%) and Food/Beverage (5%). If equal numbers of CEO’s had positive and negative perceptions of and expectations for the general economy as well as for the condition of and future for their industry, the overall index would be 100. Financial (108.8), Wholesale/Distribution (98.4), Service (90.6), and Retail (89.6) have the highest overall index readings but all industry sectors were down from last year.

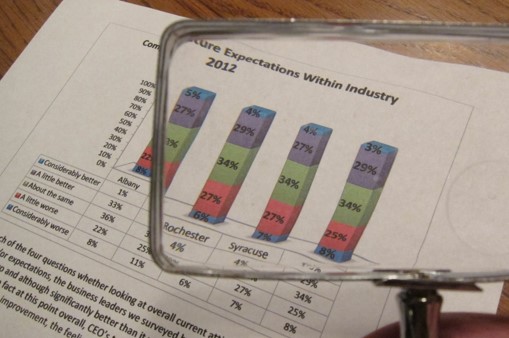

Thirty-eight percent (up from 24%) of CEO’s say that business conditions have worsened in Pennsylvania over the last half of 2012 while only 20 percent feel as though the economy has improved. Pennsylvania has declined today to a point at which more CEO’s say conditions have again worsened rather than improved. Looking to the future, where last year about twice as many were bullish rather than bearish towards the upcoming year both across the state and within their industry, today at best equal percentages of CEO’s anticipate improving economic conditions as do those that expect declines.

Based upon CEO’s responses to the four key index questions, the study identifies three distinct groups of business leaders today in Pennsylvania. Twenty-six percent of CEO’s, down from 39 percent a year ago, report being able to currently thrive and are strongly optimistic about the future. Forty-seven percent of CEO’s (up from 44% in 2011) acknowledge being seriously impacted by recent economic conditions and while they do not expect things to get worse, they do not anticipate improvement in 2013. The remaining 27 percent (up from 17% a year ago) have been very seriously affected by the economy and believe that economic conditions may continue to worsen in both Pennsylvania and their industry before getting better.

Revenues, Profits, Fixed Assets and Labor Force

Expectations for revenues and profits through 2013 are down among CEO’s this year. CEO’s plans to acquire new fixed assets are strong and unchanged from last year but fewer plan to enlarge their workforce this year while slightly more than last year do intend to decrease employment.

Thirty-seven percent of CEO’s (down from 46% last year) anticipate increasing revenues during 2013, and 26 percent, up from 20 percent last year, expect less revenue. Twenty-nine percent anticipate increasing profitability this year (down from 36%) while 37 percent (up from 25%), continue to expect profitability declines.

Despite declining confidence and lessened expectations towards revenues and profits, fixed asset acquisition plans held constant this year at 45 percent (46% in 2011). Of those that do anticipate asset acquisitions, 58 percent plan to use internally generated funds as opposed to either borrowing from a financial institution (33% up from 31%) or private equity (4%).

Twenty-three percent of business leaders expect to at least moderately increase their workforce in 2013 down from 30 percent a year ago. While 63 percent intend to have their workforce remain the same, 13 percent, up from 9 percent, plan on decreasing their labor force. Pennsylvania’s CEO’s are disappointed in not having had a better year and still leery of the future will invest in necessary fixed assets but given their deflated confidence, are less likely to increase their workforce.

Concentrations, Challenges and Attitudes towards Government

CEO’s are most focused on growing their market and demand for their products or services in order to enhance profits, but with 30 percent still stressing cost reductions and a growing percentage (13%) now planning to increase prices, many do not believe they will be able to expand their market share this year.

The top two concerns among Pennsylvania business leaders are, when asked to name their single most vexing problem, governmental regulation (23%) and adverse economic conditions (22%) with at least 12 percent citing health care costs or taxation.

Thirty-four percent say the government of Pennsylvania has been doing a poor job of creating a business climate in which their company can succeed and 68 percent are either not very or not at all confident in the ability of the government to improve the business climate in Pennsylvania. As bad as that assessment of state government is, these CEO’s have an even more negative judgment of the federal government. Over three-quarters say D.C. is doing a poor job of creating a successful business climate. In Pennsylvania they advocate spending cuts, business incentives and tax reform. On other issues, they strongly call for the development of domestic energy supplies, a balanced budget amendment, reducing corporate taxes, capping increases of federal regulatory spending increases at $0, repealing the health care reform legislation, and ending the unemployment benefits extension. A majority oppose an increase in taxes for those making over $250,000 a year.