Survey Shows More Upstate NY Business Leaders

Optimistic Than Pessimistic About 2012 State Business Climate

Confidence Levels for Future Remain Slightly Positive, But Company Heads Will Operate With Caution in the “New Normal” Post-Recession Environment

ALBANY, N.Y. – January 31, 2012 – More Upstate New York private sector business leaders expect business conditions to get better in New York State in 2012 than those who predict they will worsen as these executives continue to cautiously operate their companies within the “new normal” created by the recession of 2008-09, according to results from First Niagara’s Fifth Annual Survey of Upstate New York Business Leaders released today.

The survey reports that 34% of business leaders say they expect economic conditions to improve in the state this year while 28% say these conditions will worsen — the lowest percentage in the survey’s five-year history and reflecting a steady decline from a high of 72% registered in 2008. Another 38% of leaders, again a five-year high, expect conditions to stay the same for 2012.

First Niagara survey findings also show these business leaders will proceed with caution in the coming year as indicated by forecasts for company revenues, profitability, workforce size, and fixed asset acquisitions that mirror levels predicted at the same time last year for 2011.

“The good news is that many business leaders continue to express more favorable expectations for their business operations and overall business conditions compared to where they were two and three years ago,” said Peter Cosgrove, Upstate New York regional president for First Niagara Bank, a wholly owned subsidiary of First Niagara Financial Group (Nasdaq:FNFG). “With a focus on business stability, these company leaders are telling us 2012 may look more like 2011 and that conditions point to a less than robust economic recovery.”

Survey results were based on responses from 636 leaders of private businesses in the four major Upstate markets of Buffalo, Albany, Rochester and Syracuse. Conducted through the Siena College Research Institute, First Niagara’s annual survey has earned a record as an accurate barometer of economic trends, correctly calling the recessionary impact for 2009 and the forecasts for recovery steps in 2010 and 2011.

“As a strong, community-oriented financial institution, we find these survey results to be a reflection of what our customers are dealing with every day across Upstate New York,” Cosgrove said. “They are looking to grow their businesses but know they must have realistic financial expectations given what they have endured in recent years.”

Responding to First Niagara’s fifth annual survey, conducted during the last two months of 2011 and first week of 2012, were chief executive officers, chief financial officers and other senior managers of private businesses with $5 million to $150 million in annual sales in the service, manufacturing, engineering and construction, retail, wholesale and distribution, financial and food and beverage industries.

The survey’s annual Confidence Index measures the current assessment and future expectations for the statewide economy and for leaders’ specific industries. The Index is based on a scale

of zero to 200 with zero being the most pessimistic and 200 being the most optimistic. Thus an index of 100 would have an equal percentage of negative and positive responses.

For this year’s survey, the overall Confidence Index of Upstate business leaders registered 97.9, which is 0.5 points lower than that recorded going into 2011 but 11.5 points higher than that recorded going into 2010 and 58.9 points higher than that registered during late 2008.

For the second consecutive year, the future Confidence Index, based on business condition expectations for the state economy and the leaders’ own industries, registered higher than 100 thus yielding more positive responses than negative. Business leaders’ expectations for 2012 resulted in a future confidence index of 103.0, on par with 103.1 recorded going into 2011, and an increase of 8.2 over 2010 and 56.1 from three years ago.

Combining responses from that question with the other three Confidence Index questions, three distinct groups of business leaders were identified in Upstate New York:

• 32% of business leaders (down from 35% last year) report being able to currently

thrive and are strongly optimistic about the future;

• 44% of business leaders (up from 39% last year) acknowledge being seriously

impacted by recent economic conditions but tend to believe things have stabilized;

• 24% of business leaders (down from 26% last year) have been very seriously affected

by the economy and believe that economic conditions may worsen in both New York

State and in their industry before getting better.

Overall, responses to the Confidence Index questions show 76% of business leaders believe economic conditions will get better or stay the same in 2012 compared to 74% last year, 66% entering 2010 and 42% entering 2009.

Upstate New York business leaders also continue to express a lack of confidence in the ability of state government to improve business conditions, but their faith in New York’s government has increased while confidence in the federal government has declined from last year’s survey results.

Key findings for Fifth Annual Survey of Upstate NY Business Leaders include:

• More than one-quarter (28%) of business leaders say current business conditions in

New York State overall improved over the last six months of 2011. Last year that

number was 29%, 28% in 2009, and 2% in 2008.

• Regarding their own industry and current economic conditions in New York State

compared to six months earlier, 41% of business leaders say they were about the same,

another 35% say a little worse or considerably worse, and 24% say a little better or

considerably better.

• As previously noted, better than one-third (34%) of business leaders say they expect

business conditions in New York State to be a little better or considerably better in

2012 compared to 35% stating such expectations for 2011 and 32% for 2010.

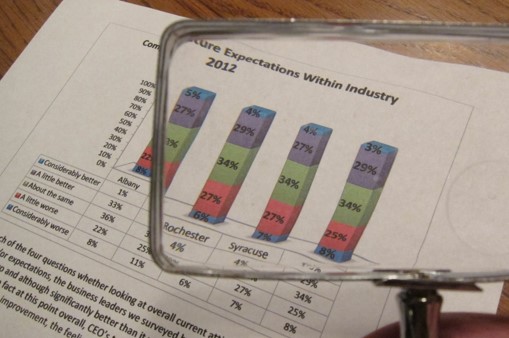

• 32% of business leaders say they expect business for their own industry in New York

State to be a little better or considerably better in 2012, with another 34% saying it will

be about the same, and 33% saying it will be a little worse or considerably worse.

• 22% of company leaders say they expect to moderately increase their current labor

force size – compared to 27% for 2011 and 21% for 2010; while 65% of the leaders

say they expect their workforce to remain the same in 2012.

• Similar to the past three years, 52% of Upstate New York business leaders

say they plan to invest in fixed asset acquisitions over the next year. Of those

who intend to invest in fixed assets, 59% plan to use internally generated funds while

32% intend to finance with the assistance of a financial institution.

• For 2012, 40% of Upstate business leaders expect their company revenues to

grow, compared to 45% last year. Another 40% of business leaders expect

revenues to stay about the same in 2012, and 20%, the smallest percentage in four

years, say they will decrease.

• In regard to projected profitability, 30% of these business leaders expect company

profits to increase in 2012, 39% say they will stay about the same, and 31% say

they will decrease.

• To enhance profitability in 2012, business leaders say they will increase demand for

market growth and penetration (40%) as their top strategy, followed by cost

reduction (38%), new technology (8%) and price increases (8%).

• To achieve these revenues and profits, business leaders say they will concentrate the

most in 2012 on expansion of existing markets (32%), growth in existing products

(20%), and entry into new markets (11%) and internal restructuring (11%).

• Overall, the number one challenge concerning Upstate New York business leaders is

adverse economic conditions (27%) followed by governmental regulation (22%),

healthcare costs (11%), and taxation (10%).

• Regarding confidence in state government‘s ability to improve the business climate in

New York State, 21% say they are very or somewhat confident, compared to only 7%

last year; and where last year 93% were not very or not at all confident , today only

79% share that sentiment.

• For confidence in the federal government’s ability to improve the business climate in

New York State, 9% say they are very or somewhat confident, compared to 12% last

year; 43% not very confident , compared to 44% last year, and 47% not at all

confident, compared to 44% last year.

METHODOLOGY

A quantitative 26-question survey was conducted during the last two months of 2011 and first week of 2012 for First Niagara by the Siena College Research Institute (SRI) in which 636 business leaders responded either by mail, on the SRI Web site, or through a personal interview. Business leaders included chief executive officers, chief financial officers and other senior managers of private businesses with $5 million to $150 million in annual sales in the service, manufacturing, engineering and construction, retail, wholesale and distribution, financial and food and beverage industries. These business leaders represented four Upstate Metropolitan Statistical Areas (MSAs): Albany (30% of respondents), Rochester (19%), Syracuse (18%) and Buffalo (31%).

# # #