Third Annual Survey of Upstate New York Business Leaders

1/20/10

Summary of Findings

Summary

The Third Annual First Niagara/Siena College Research Institute Survey of Upstate New York Business Leaders shows that CEO confidence has risen dramatically since last year. CEO’s remain concerned and, as a whole, cautious. But, a growing percentage see an increasingly bright future and, despite worries about adverse economic conditions and governmental regulation, are going about the business of business. Still, only those that are most confident predict an uptick this year in profits, or hiring. Overall, the CEO’s of upstate New York know that they have withstood an epic downturn and now although economic conditions and governmental regulation remain challenging, a majority are more optimistic than they were and they expect 2010 to be a better year.

Business Leader Confidence

The overall Index of Upstate New York Business Leaders reached 86.4 up 47.4 points from last year. The Index remains below the 100 mark at which equal percentages of CEO’s are both optimistic and pessimistic about economic conditions in their industry and across the state. The current index component that assesses business conditions today as compared to six months earlier is now 78.1 up from 31.1 a year ago and the future component that measure expectations for the coming year is 94.8 up from 46.9. Thirty-two percent of CEO’s of private, for-profit companies with sales between $5 million and $150 million in the Capital Region, Buffalo, Rochester and Syracuse now expect better economic conditions in New York next year compared with 41 percent that anticipate worsening conditions up from 11 percent optimistic, 72 percent pessimistic last year.

This survey reports data from 459 corporate leaders drawn from Service (25%), Manufacturing (17%), Engineering/Construction (17%), Retail (16%), Wholesale/Distribution (14%), Financial (5%) and Food/Beverage (5%). In order to quickly make sense of how these CEO’s feel about the economy, their place within it and the conditions they expect for the coming year, the Siena College Research Institute has developed an index of Upstate New York Business Leaders from the data in this survey. If equal numbers of CEO’s had positive and negative perceptions of and expectations for the general economy as well as for the condition of and future for their industry, the overall index would be 100.

Forty-seven percent of CEO’s continue to say that business conditions have worsened in New York over the last half of 2009 while 28 percent feel as though the economy has already improved. Despite the plurality of worsening current perception, today’s assessment is far better than last year’s when only 2 percent thought things had improved as 2008 ended against 83 percent that saw worsening conditions.

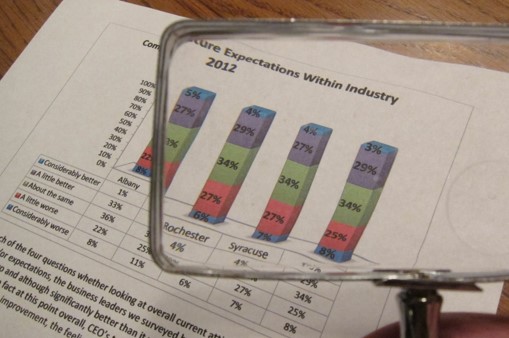

The Index of Upstate New York Business Leaders simultaneously measures and reports CEO’s perception of their current and future assessment of the state business conditions as well as how those conditions have and will impact their industry. Of the four upstate MSA’s (metropolitan statistical areas), the index is greatest in the Capital Region (95.4 overall, 85.9 current, 104.9 future) followed by Rochester (83.8, 77.2, 90.5), Syracuse (80.8, 72.0, 89.6) and Buffalo (79.6, 71.8, 87.4). All individual industries experienced increases in their index scores with Retail (93.2) now highest followed by Service (89.7), Financial (88.6), Wholesale/Distribution (86.3), Engineering/Construction (84.4), Manufacturing (83.8) and Food/Beverage (65.2).

Based upon CEO’s responses to the four key index questions, the study identifies three distinct groups of business leaders today in Upstate New York. Thirty percent of CEO’s report being able to currently thrive and are strongly optimistic about the future. Not only is this group more than double the size of those that were most positive last year (14%), but as a group both their current and future outlooks have greatly improved. Thirty-six percent of CEO’s (up from 27%) acknowledge being seriously impacted by recent economic conditions, but they tend to feel as though things are beginning to improve and, as a group, now have a future confidence level of 101.2. The remaining 34 percent (down from 58%) have been very seriously affected by the economy and believe that economic conditions will worsen in both New York and their industry before getting better.

Revenues, Profits and Labor Force

Expectations for revenues and profits through 2010 increased among CEO’s compared to this time last year. But, CEO’s intent to retain or enlarge their workforce, or to acquire new fixed assets is virtually unchanged from last year.

Thirty-five percent of CEO’s anticipate increasing revenues during 2010 as compared to 26 percent last year, and 31 percent expect less revenue this year as compared to 40 percent having that expectation last year. Thirty percent anticipate increasing profitability this year (up from 21%) while a slightly larger number, 38 percent (down from 47%), continue to expect declines.

Despite increasing confidence and growing expectations of higher revenues and profits, fixed asset acquisition plans remain at just over 50 percent. Of those that do anticipate asset acquisitions, a greater percentage (65% compared to 48% last year) plan to use internally generated funds as opposed to either borrowing from a financial institution (26%) or private equity (3%).

Twenty-two percent of business leaders expect to at least moderately increase their workforce in 2010 up just slightly from 19 percent a year ago. While 62 percent intend to have their workforce remain the same, 17 percent, down from 20 percent, plan on decreasing their labor force. Two years ago at the time when most agree the recession was just beginning, 36 percent of CEO’s said they planned to increase their workforce as compared to only 6 percent anticipating reductions.

Concentrations and Challenges

While 2009 in New York was a year of caution, highlighted by cost cutting and survival among these small and medium sized companies, today a growing number of CEO’s are becoming more focused on growing the market for their products and services. Market growth as a top profit enhancement strategy is up from 28 percent a year ago to 40 percent today. Still, 42 percent continue to put cost reductions first with optimistic companies tending to target growing sales while the more pessimistic companies still primarily look to cost cuts as a business strategy.

Overwhelmingly, the number one concern among upstate New York business leaders is adverse economic conditions (25%) followed by governmental regulation (22%), and taxation (15%). Health care was mentioned by three in four but only 9 percent see it as the top concern.