Second Annual Survey of New York State Business Leaders

Business Leader Confidence: Current and Future

By a margin of nearly 42:1 (83% to 2%), CEO’s of private, for-profit companies with annual sales between $5 million and $150 million in the Capital Region, Buffalo, Rochester and Syracuse think the business conditions in NY State are worse today than they were six months ago. Looking forward across 2009, 17% see conditions remaining the same as they are now, 11% expect improved conditions but 72% expect economic conditions to worsen.

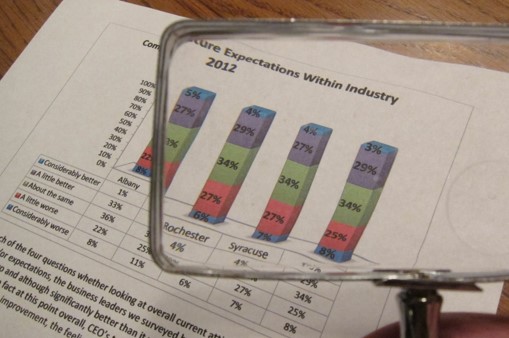

Within their own industry, CEO’s feel that conditions have worsened by a margin of 8: 1 with 27% seeing conditions as stable. Expectations within their own industry are better than their predictions for the overall state economy but still 60% of CEO’s expect conditions within their industry to worsen, with 25% expecting conditions to remain the same and 15% predicting improved conditions.

This survey reports data from 404 corporate leaders drawn from manufacturing (21%), wholesale and distribution (14%), service (23%), engineering and construction (16%), retail (14%), financial (6%) and food and beverage (5%). In order to quickly make sense of how these CEO’s feel about the economy, their place within it and the conditions they expect for the coming year, the Siena College Research Institute has developed an index of New York State Business Leaders from the data in this survey. If equal numbers of CEO’s had positive and negative perceptions of and expectations for the general economy as well as for the condition of and future for their industry, the overall index would be 100.

The overall Index of New York State Business Leaders this year is 39.0 down 38.7 from last year’s 77.7. The current index (again 100 is the benchmark of equal percentages positive and negative) is 31.1 down from last year’s 76.3 and the index of future expectations statewide is 46.9 down from last year’s 79.2. Of the four MSA’s (metropolitan statistical areas) Syracuse has the highest overall index at 41.5 down 13.1 points from last year. Rochester at 41.2 dropped 35.1 points from last year, Buffalo has an overall index of 37.2 down from 87.8 and Albany at 38.0 is down 43.7 from last year.

Based upon CEO’s responses to the four key index questions, the study identifies three distinct groups of business leaders today in Upstate New York. Fourteen percent of CEO’s report being relatively unaffected by the current economic downturn and they are optimistic about future. Twenty-seven percent of CEO’s acknowledge being seriously impacted by recent economic conditions but tend to feel as though things will not get any worse. The remaining 58% have been very seriously affected by the economy and believe that economic conditions will worsen in both New York and their industry before getting better. The overall index for the three groups are: 122.8, 58.4 and 9.3.

Revenues, Profits and Labor Force

Expectations for revenues and profits through 2009 are significantly lower among CEO’s than they were this time last year and although most CEO’s intend to retain or enlarge their workforce, over three times as many plan to decrease their staff when compared to last year. Twenty-six percent of CEO’s anticipate increasing revenues during 2009 as compared to 51% last year and 40% expect less revenue this year as compared to only 15% having that expectation last year.

Profitability follows a similar pattern with the percent expecting increased profits down this year to 21% from 40% last year. Forty-seven percent of CEO’s expect lessened profitability this year compared to last year’s 27%.

Sixty-one percent of company leaders expect to keep their labor force at the same size similar to last year when 58% made that prediction. The difference this year is that 20% expect to decrease their work force where last year only 6% made that prediction. Where last year 36% predicted at least a moderate labor force increase, this year only 19% make that projection.

Concentrations and Challenges

2009 in New York is set up to be a year of caution, cost cutting and survival among these small and medium sized companies. The CEO’s intend to concentrate on cost reductions (45%) followed by growing demand for their products in existing markets (28%). In other words, these CEO’s do not overall intend to risk but rather to concentrate on doing what they currently do with an eye on controlling costs, hiring only as necessary, and borrowing only as needed. Fifty-eight percent see the economy worsening before it gets better. Still, they do not intend to close the doors. In fact, 52% of all CEO’s plan to acquire fixed assets this year.

Overwhelmingly, the number one concern among New York business leaders is the economic downturn (70%) followed by taxation (62%), energy costs (56%), rising supplier costs (53%), governmental regulation (47%) and cash flow (43%). All of these factors are outside of their control but as these CEO’s know, they can dramatically impact their profitability.

Summary

The Second Annual First Niagara/Siena College Research Institute Survey of New York Business Leaders shows that CEO’s in upstate New York are committed to their firms, clients, and workers, but worried about an economy that has and is seriously hampering their ability to succeed. Overall they are braced to try to work their way through this challenging time. They know that 2009 will be a difficult year in which cost reductions, internal restructuring and potential staff cuts will occupy their efforts as much or more than increasing sales and profits. Many do indeed feel as though they have been hit by an economic tsunami. As a group upstate CEO’s are digging in and looking towards a general economic revival that will reward their diligent efforts.