- NY’ers, Especially NYC, Remain Optimistic About the Future; Current Outlook Drops by 3 Points Statewide, by 8 Points Upstate

- Gas Price Concerns Inch Upward as Food Price Worries Drop Slightly; Buying Plans Steady and Strong for Cars & Homes, Down for Home Improvements

Press Release Summary Trends Buying Plans Gas and Food

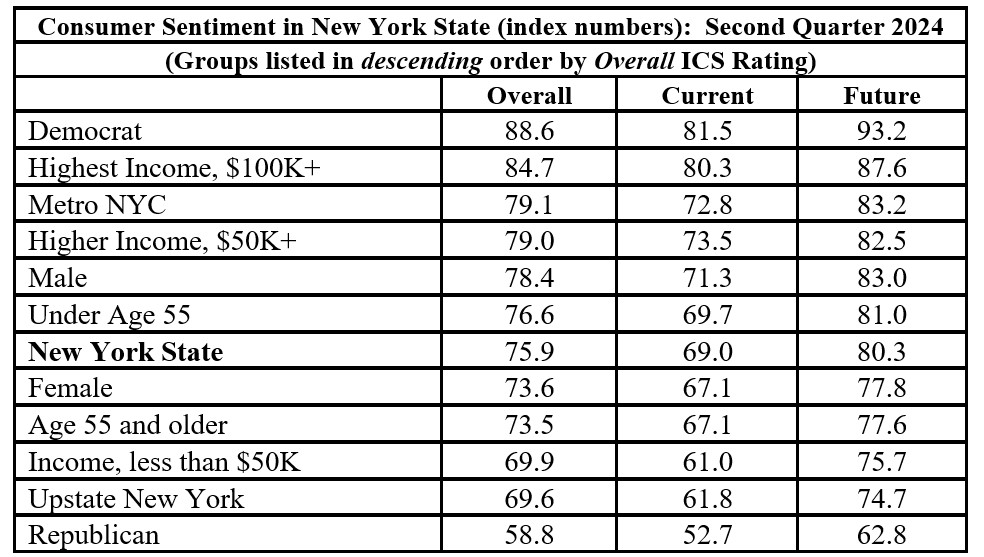

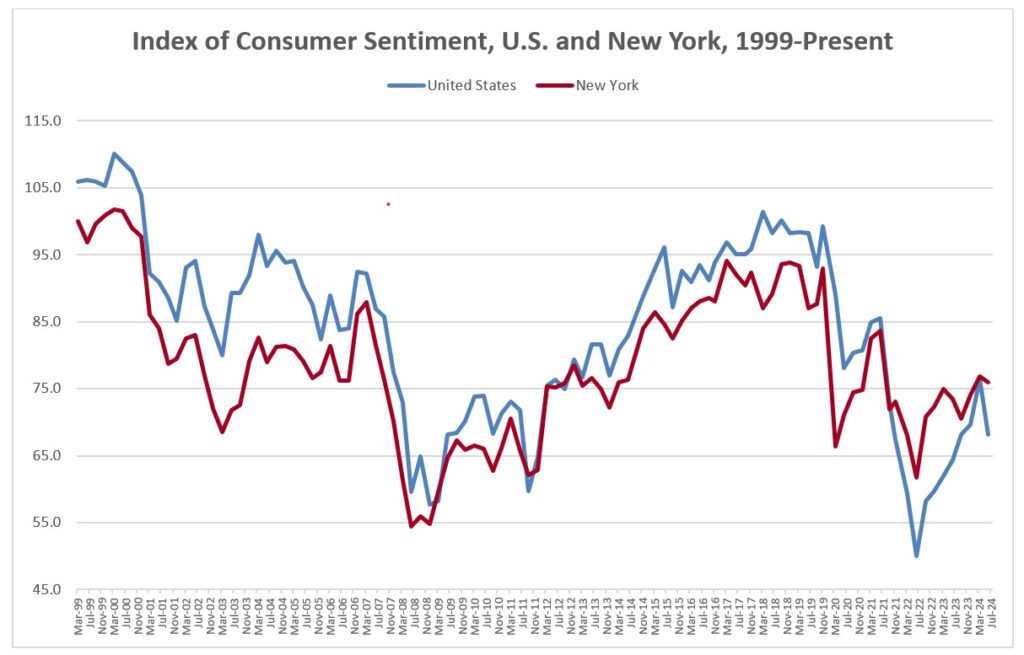

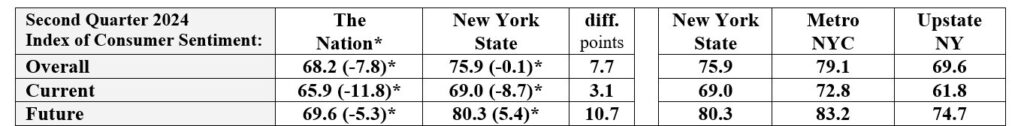

Loudonville, NY – The New York State Index of Consumer Sentiment now stands at 75.9 down one point from the last measurement in the first quarter of 2024 and virtually at the breakeven point at which optimism and pessimism are balanced according to the latest poll by the Siena College Research Institute (SCRI). Nationally, the overall index decreased nearly twelve points this quarter. New York’s overall Index of Consumer Sentiment is 7.7 points above the national* index of 68.2. New York’s current index decreased 3.4 points to 69.0 and the future index increased 0.5 points to 80.3. Future confidence in New York is now 5.4 points above the breakeven point of balanced optimism and pessimism and 10.7 points higher than national future confidence.

“Statewide consumer sentiment continued to hover right around the breakeven point of balanced optimism and pessimism with a slight increase in future outlook and a decline in New Yorkers’ assessment of current conditions. New York City residents continue to be far more bullish on economic conditions than are residents outside of the metro area. Nationally the index, down 7.8 points this quarter, lags behind New York by nearly 8 points. While high food price concerns fell ever so slightly this quarter, panic at the gas pump was up by four points as the summer driving season started. Housing, utility and streaming service cost concerns all climbed this quarter. Still, one in five plan to shop for a new vehicle. Nearly as many are looking to do some home improvements, a drop from last year of over six points,” according to Don Levy, SCRI’s Director.

In the first quarter of 2024, buying plans were up for cars/trucks at 20.8% (from 19.7%) and up slightly for homes at 8.4% (from 8.3%). Buying plans were down for consumer electronics at 43.6% (from 47.9%), for major home improvements at 19.8% (from 22.7%), for and furniture at 24.7% (from 29.8%).

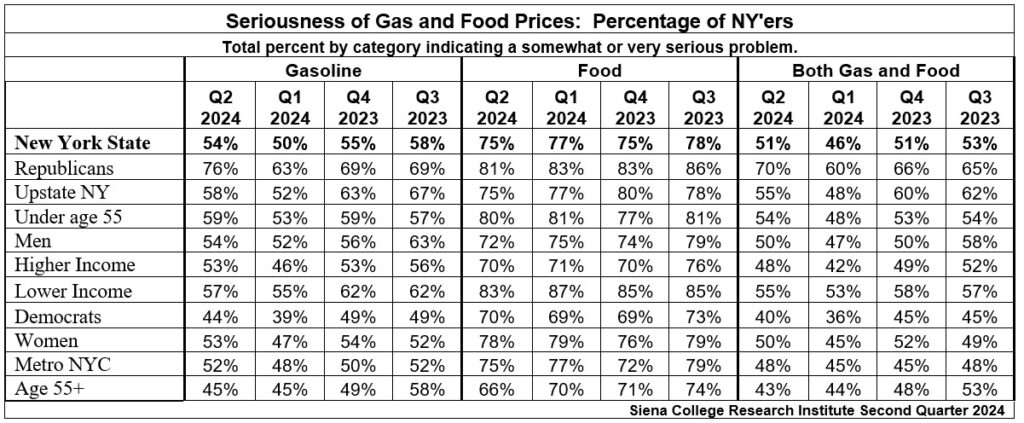

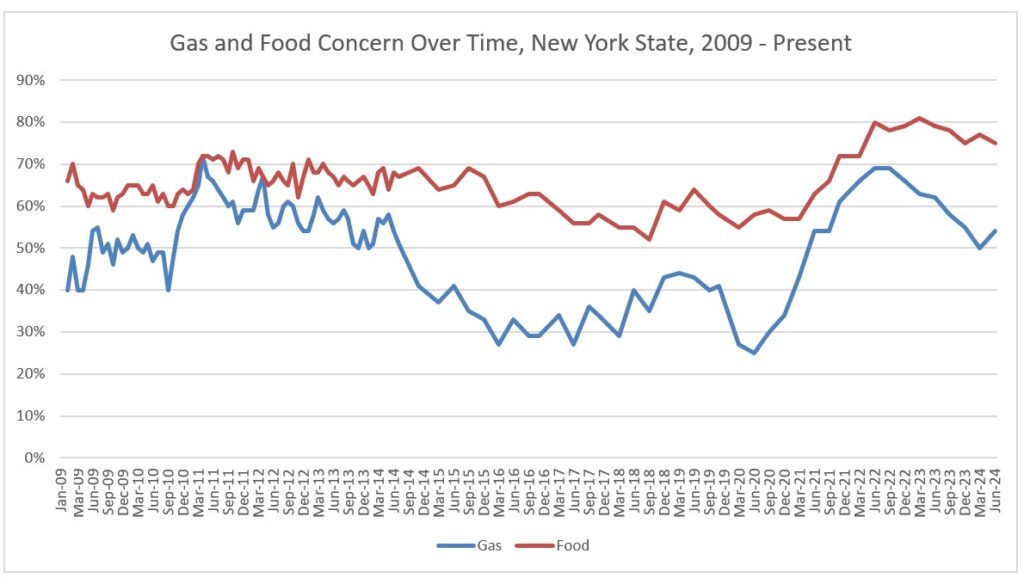

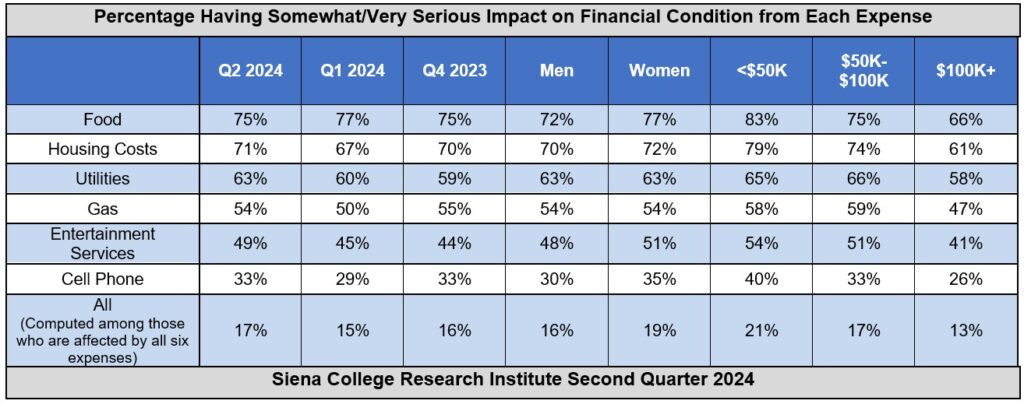

Fifty-four percent (up from 50% last quarter) of all New Yorkers say that current gasoline prices are having a very serious or somewhat serious impact on their financial condition. Seventy-five percent (down from 77% last quarter) of state residents indicate that the amount of money they spend on groceries is having either a very serious or somewhat serious impact on their finances.

Seven in ten (71%) New Yorkers say that housing costs are having a very serious or somewhat serious impact on their financial condition. Additionally, a majority (63%) of residents say that their utility costs are having at least a somewhat serious impact on their finances. Other monthly expenses including the cost of cell phones (33%) and entertainment services including internet, cable and streaming services (49%) are having a very or somewhat serious impact on New Yorkers’ financial condition.

Seventeen percent of all New Yorkers are somewhat or very seriously impacted by all six monthly expenses – food, gasoline, housing, utilities, home entertainment and cell phones. The consumer sentiment index among that group of New Yorkers is 65.5, 10.4 points below the statewide reading.

This Siena College Poll was conducted June 17 – June 29, 2024, among 806 New York State Residents. Of the 806 respondents, 423 were contacted through a dual frame (landline and cell phone) mode (100 completed via text to web) and 383 respondents were drawn from a proprietary online panel (Cint). Telephone calls were conducted in English and respondent sampling was initiated by asking for the youngest person in the household. Telephone sampling was conducted via a stratified dual frame probability sample of landline and cell phone telephone numbers weighted to reflect known population patterns. The landline telephone sample was obtained from ASDE and the cell phone sample was obtained from Dynata. Interviews conducted online are excluded from the sample and final analysis if they fail any data quality attention check question. Duplicate responses are identified by their response ID and removed from the sample. Three questions were asked of online respondents including a honey-pot question to catch bots and two questions asks the respondent to follow explicit directions. The proprietary panel also incorporates measures that “safeguard against automated bot attacks, deduplication issues, fraudulent VPN usage, and suspicious IP addresses”. Coding of open-ended responses was done by a single human coder. Data from collection modes was weighted to balance sample demographics to match estimates for New York State’s population using data from the Census Bureau’s 2023 U.S. American Community Survey (ACS), on age, region, race/ethnicity, and gender to ensure representativeness. The sample was also weighted to match current patterns of party registration using data from the New York State Board of Elections. The overall results has an overall margin of error of +/- 3.9 percentage points including the design effects resulting from weighting when applied to buying plans and/or the perceived impacts of gas and food prices. As consumer sentiment is expressed as an index number developed after statistical calculations to a series of questions, “margin of error” does not apply to those indices. Sampling error is only one of many potential sources of error and there may be other unmeasured error in this or any other public opinion poll. The Siena College Research Institute, directed by Donald Levy, Ph.D., conducts political, economic, social and cultural research primarily in NYS. SCRI, an independent, non-partisan research institute, subscribes to the American Association of Public Opinion Research Code of Professional Ethics and Practices. For more information or comments, please call Dr. Don Levy at 518-783-2901. Survey cross-tabulations and buying plans can be found at www.siena.edu/scri/cci.

Appendices