- Upstate NY CEO Confidence Plummets; 54% Say Economy has Worsened and Only 19% Expect 2023 Improvement

- Revenue & Profit Projections Down Sharply from Last Year; 85% Say Inflation Having Negative Impact; Over Half Will Still Invest in Fixed Assets

- 75% Having Difficulty Filling Open Positions; Many Increasing Wages, Offering Flexible Hours but CEOs Oppose Increasing Minimum Wage to $15 by 59-31%, Say Higher Minimum Wage Will Hurt Business

Loudonville, NY. Fifty-four percent of Upstate New York CEOs say business conditions have worsened over the last year and only 19%, down from 36% a year ago, expect improvement in the coming year according to the 16th annual Upstate New York Business Leader Survey from Siena College Research Institute (SCRI) sponsored by the Business Council of New York State, Inc. Only 23% of CEOs say the economy has improved this year and 54% up from 41% last year see worsening conditions in the next year.

Thirty-eight percent, down from 47% last year, predict increasing revenues in 2023 while 26%, down from 34%, anticipate growing profits in the year ahead. Still, unchanged from last year, over half, 55%, intend to invest in fixed assets in 2023. Eighty-five percent say inflation is having a negative impact on profitability.

One-third of CEOs, down from 44% last year, plan to increase the size of their workforce this year, but 82% say that there is not an ample supply of appropriately trained local workers. Seventy-five percent are having difficulty recruiting for their open positions despite 72% offering increased wages and 53% being flexible with work hours. By 61-5% CEOs believe increasing the minimum wage to $15 an hour Upstate would have a negative rather than positive impact on the economy and they oppose the increase by 59-31%.

“It’s impossible to sugarcoat the findings of this survey. CEO confidence is down dramatically from a year ago once again reaching the low point we saw in 2020 and greater now only than during the Great Recession of 2008,” said Siena College Research Institute Director Don Levy. “Only about 1 in 5 CEOs now say conditions have been and will continue to improve while about half say the opposite – conditions have and will continue to worsen.”

“Our index of business leader sentiment, a measure that considers both the current and future views of CEOs is down to 68.8 from 94.4 last year and about equal to 68.7 recorded in 2020 during the raging pandemic,” said Levy. “Two disturbing insights from these numbers. First, a score of 100 indicates equal levels of optimism and pessimism, we’ve got a long way to go, and secondly, in 2020, the current component was the problem as CEOs then predicted a better future, now both the current and future measures are over 30 points below 100.”

Leading a long list of challenges, 65% of CEOs, up from 56%, name adverse economic conditions. Eighty-five percent say that inflation is having either a moderately (52%) or substantially (33%) negative effect on their company’s profitability. And in response, 73% are turning around and raising the prices they charge their clients and customers. Only 14% think the recently passed Inflation Reduction Act will have a positive impact.

“CEOs are struggling to maintain profitability in the face of inflation,” Levy said. “While governmental regulation, rising supplier costs, healthcare costs, taxes and energy costs all weigh on Upstate CEOs, many are raising their prices while still trying to cut their costs. Currently the solution to this Rubik’s cube is unclear to most CEOs. Is there a ray of hope? Sixty-seven percent of CEOs, up from 59% a year ago expect that their business will still be doing business in New York in ten years.”

Attitudes toward Government

Only 11% think the government of New York is doing either an excellent or good job of creating a business climate in which companies like theirs can succeed. Over half would like to see the Governor and Legislature focus on business and personal tax reform and spending cuts while about 40% call for infrastructure development, workforce development and business development incentives. Looking to the future, only 17% are confident in the ability of New York’s government to improve the business climate over the next year.

By 89-5%, CEOs oppose paying the nearly $8 billion Unemployment Insurance (UI) debt through increased payroll taxes paid by the employer and 84% say increased UI taxes would have a very (33%) or somewhat (51%) serious impact on their business. Most, 60%, say that the Climate Leadership and Community Protections Act (CLCPA) will have a negative impact on their profitability and by 64-16%, CEOs think the CLCPA will have a negative rather than positive impact on the New York State economy.

“Loudly and clearly, Upstate CEOs say that Albany isn’t making it any easier for them to be successful,” Levy said. “Business leaders are telling New York’s leaders to cut spending, curtail regulation, and work to make it easier rather than harder for businesses, the engine of New York, to be successful. At present, while 38% say that if they had it to do all over again they would locate their business in New York, a majority, 53% say that they would if they could have located someplace else.”

Disruptive Technologies

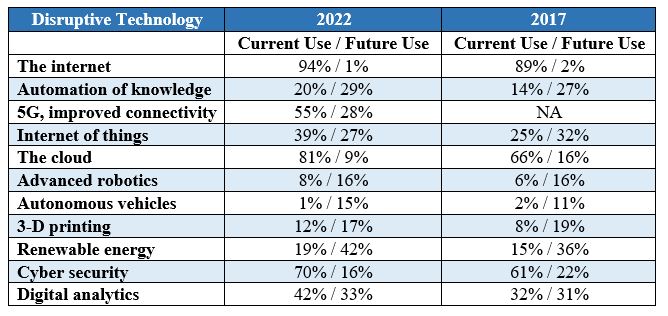

Forty-three percent of CEOs say that they are either very (13%) or somewhat (30%) familiar with ‘Disruptive Technologies’, innovations that significantly alter the way that consumers, industries or businesses operate. Current use of disruptive technologies has increased since SCRI last measured CEO adoption in the 2017 survey.

“More CEOs and their businesses are using various disruptive technologies today than were five years ago,” Levy said. “Virtually everyone now uses the internet and the ‘cloud’ and we’ve seen increasing use of cyber security, but while CEOs describe growth in using the internet of things, digital analytics and 3-D printing, many CEO’s still see those technologies as the future and not the present.”

Currently 80% of CEOs see disruptive technologies more as an opportunity for their business than as a threat and 52% say that the COVID-19 pandemic resulted in an increase in the use of disruptive technologies.

From The Business Council of New York State, Inc.

“We see the results of this poll showing that, as a whole, employers are still concerned about major policies the state is considering that will adversely impact their business while also being frustrated about the lack of assistance and relief being shown to the business community. Employers continue to work hard every day to manage a fluctuating economy, a shrinking workforce, and policies that dissuade them from investing and growing in New York.” – Heather Mulligan, President & CEO of The Business Council of New York State

******

This Siena College Poll was conducted November 2022 – February 2023 by mail and internet interviews with 530 Business Leaders from across Upstate including the Capital Region, Central/Mohawk Valley New York, the Finger Lakes region, the Mid-Hudson region, the Southern Tier region, Westchester and Western New York. Sponsorship for the 2022 Upstate Business Leader Survey was provided by The Business Council of New York State, UHY Advisors and HVEDC. The Siena College Research Institute, directed by Donald Levy, Ph.D., conducts political, economic, social and cultural research primarily in New York State. SCRI, an independent, non-partisan research institute, subscribes to the American Association of Public Opinion Research Code of Professional Ethics and Practices. For more information, call Don Levy at (518) 783-2901 or dlevy@siena.edu. For survey cross-tabs and frequencies: www.Siena.edu/SCRI