Second Annual Survey of Southwestern New England Business Leaders

1/15/13

Summary of Findings

Summary

The Second Annual First Niagara Survey of Southwestern New England Business Leaders conducted by the Siena College Research Institute (SRI) shows that CEO confidence has fallen significantly from a year ago. Today, more business leaders are negative about their current economic picture and fewer are optimistic about the year ahead. A majority of the most confident (nearly 32%) predict an uptick this year in profits and nearly half of the most confident expect an increase in hiring. However, most see a challenging year and taken as a whole, business leaders anticipate lessening revenues, profits and tepid job increases. An overwhelming percentage lack confidence in the ability of state and federal political leaders to help in creating a business climate in which they can succeed. Still, with polls showing heightened consumer sentiment and willingness to spend among consumers in Connecticut and Massachusetts, CEO’s who have cut all that can be cut may find much needed relief in the renewed activity consumers promise. Commerce will take place in 2013 and companies that innovatively meet consumer and client needs and demand will benefit from forecasted revitalized but cautious consumer spending.

Business Leader Confidence

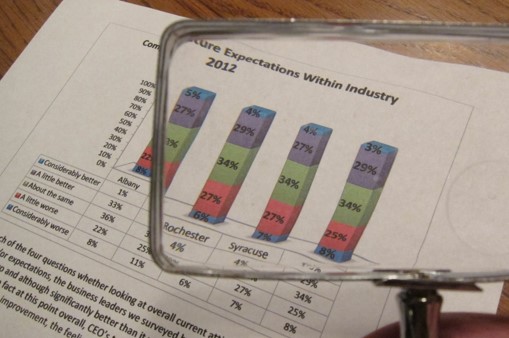

The overall Index of Southwestern New England Business Leaders is down 13 points to 94.3 down from 107.3. The Southwestern New England Index is over 8 points above the index for Upstate New York and over 5 points higher than this year’s Pennsylvania score. The Index has fallen below the 100 mark at which equal percentages of CEO’s are both optimistic and pessimistic about economic conditions in their industry and across their state. The current index component that assesses business conditions today as compared to six months earlier is 87.4 down from 99.7 and well beneath the breakeven point. The future component that measures expectations for the coming year is 101.1, down from 114.8 but just above 100 indicating slightly more optimism than pessimism among CEO’s as they look to the future. Thirty-five percent (down from 41% a year ago) of CEO’s of private, for-profit companies with sales between $5 million and $150 million in the Connecticut counties of Fairfield, Hartford, Middlesex, New Haven, Tolland and Windham and the Massachusetts counties of Hampden and Worcester now expect better economic conditions in their area next year. Thirty-one percent, up from 24 percent, expect worsening conditions.

This survey reports data from 361 corporate leaders drawn from Service (26%), Manufacturing (26%), Retail (13%), Engineering/Construction (13%), Wholesale/Distribution (11%), Financial (9%), and Food/Beverage (2%). If equal numbers of CEO’s had positive and negative perceptions of and expectations for the general economy as well as for the condition of and future for their industry, the overall index would be 100. Of those industries with substantial representation in the survey, Service (102.9) and Engineering/Construction (99.5) have the highest overall index readings. Of four Southwestern New England areas, the index is greatest in Central CT (105.4 overall, 98.3 current, 112.5 future) followed by the two Massachusetts counties (93.8, 85.5, 102.0), Fairfield (86.5, 88.5, 84.6) and the New Haven area (85.9, 75.3, 96.5).

Thirty-eight percent (up from 29%) of CEO’s say that business conditions have worsened in Southwestern New England over the last half of 2012 while 25 percent (down from 32%) feel as though the economy has improved recently.

Based upon CEO’s responses to the four key index questions, the study identifies three distinct groups of business leaders today in Southwestern New England. Thirty-two percent (down from 39%) of CEO’s report being able to currently thrive and are strongly optimistic about the future. Thirty-nine (40% last year) percent of CEO’s acknowledge being seriously impacted by recent economic conditions, but they tend to feel as though things have stabilized or are just beginning to turn around. The remaining 29 (up from 21%) percent have been very seriously affected by the economy and believe that economic conditions may continue to worsen in both Southwestern New England and their industry before getting better.

Revenues, Profits and Labor Force

Compared to last year, lessening percentages of CEO’s have robust expectations for revenues and profits through 2013. Additionally, a smaller percentage of CEO’s plan to acquire new fixed assets this year and fewer business leaders plan to enlarge their workforce this year as compared with last while slightly more are contemplating lessening their workforce.

Forty-one percent of CEO’s (49% last year) anticipate increasing revenues during 2013 as compared to 21 percent that expect less revenue this year. Thirty-three percent (39% last year) anticipate increasing profitability this year while only 31 percent (up from 24%) expect declines.

Despite lowered confidence and expectations for revenues and profits, 45 percent of all CEO’s intend to invest in fixed assets designed to meet growing demand, reduce costs or enhance productivity. Plans to invest are down from 53 percent a year ago and CEO’s cautiously continue to plan to finance those purchases internally (62%) rather than through leverage (26%).

Twenty-five percent (down from 28%) of business leaders expect to at least moderately increase their workforce in 2013. While 61 percent intend to have their workforce remain the same, 13 percent (up from 9%) plan on decreasing their labor force. Hiring plans exceed layoffs but at a reduced rate and CEO’s continue to grow only when necessary. While this prudent approach may assist profitability it will not as yet do more than chip away at current unemployment figures.

Concentrations, Challenges and Attitudes towards Government

As Southwestern New England CEO’s work to succeed in an economy that appears to them to have taken a step backwards, they are split between those that focus on market and demand growth (36%) and those that continue to cut costs as a strategy (31%). Optimistic CEO’s target growing sales while the more pessimistic companies still primarily look to cost cuts as a business strategy.

Over three-quarters of CEO’s cite health care costs as a challenging concern while 70 percent continue to worry about adverse economic conditions and over 60 percent are concerned with governmental regulation and taxation.

Forty-three percent of CEO’s call on their Governor and Legislature to cut spending as their top focus. While CEO’s continue to lack confidence in the ability of their state government to improve business conditions, their faith in state government is stronger than their faith in the federal government. CEO’s strongly support domestic energy development, a balanced budget amendment, reducing corporate income tax rates, capping annual increases in federal regulatory spending at $0, and repealing the recent health care legislation.