Sixth Annual Survey of Upstate New York Business Leaders

(Based on Interviews with 1,142 CEO’s from the 55 New York State Counties outside of New York City and Long Island)

Summary

The Sixth Annual First Niagara Survey of Upstate New York Business Leaders conducted by the Siena College Research Institute (SRI) shows that CEO confidence has fallen and is now significantly more negative than positive for the first time in three years. After recovering from the depths of the recession of 2007-8, and expressing growing optimism for several years, many CEO’s are now frustrated with the economy, and today anticipate declining revenues and profitability in 2013. A majority of the most confident (about a quarter) predicts an uptick this year in profits and hiring but most see a more difficult year for businesses in the state. An overwhelming but lessening percentage of the CEO’s of upstate New York lack confidence in the ability of New York’s political leaders to help in creating a business climate in which they can succeed. Still, with polls showing heightened consumer sentiment and willingness to spend in the Empire State, CEO’s who have cut all that can be cut may find much needed relief in the renewed activity consumers promise. Commerce will take place in 2013 and companies that innovatively meet consumer and client needs and demand will benefit from forecasted revitalized but cautious consumer spending.

Business Leader Confidence

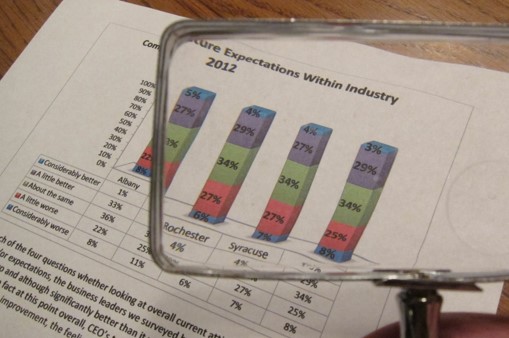

The overall Index of Upstate New York Business Leaders fell 12 points from 97.9 last year to 85.9 today. The Index is, for the first time in three years, well below the 100 mark at which equal percentages of CEO’s are both optimistic and pessimistic about economic conditions in their industry and across the state. The current index component that assesses business conditions today as compared to six months earlier dropped 12.2 points to 80.6 from 92.8 a year ago and is now only 2.5 points above the 2009 reading. The future component that measures expectations for the coming year slipped nearly 12 points from last year at 91.2 falling below the breakeven point for the first time in three years. Twenty-nine percent of CEO’s of private, for-profit companies with sales between $5 million and $150 million in the Capital Region, Buffalo, Rochester, Syracuse and this year including also Westchester, the Hudson Valley and all New York Counties outside of New York City and Long Island now expect better economic conditions in New York next year. A plurality for the first time since January 2010, 37 percent, compared to 28 percent last year, anticipate worsening conditions.

This survey reports data from 1,142 corporate leaders drawn from Service (24%), Manufacturing (20%), Retail (18%), Engineering/Construction (13%), Wholesale/Distribution (12%), Financial (6%) and Food/Beverage (6%). If equal numbers of CEO’s had positive and negative perceptions of and expectations for the general economy as well as for the condition of and future for their industry, the overall index would be 100. Food/Beverage (94.2 up 3.2), Financial (93.6 down 15.8), Wholesale/Distribution (88.6 down 7.0), Service (86.9 down 12.5) and Engineering/Construction (86.3 down 0.7) have the highest overall index readings. Of five upstate regions, the index is greatest in Albany (96.3 down 6.5), followed by Rochester (91.8 down 7.8), Syracuse (89.0 down 5.4), Hudson Valley/Westchester (83.5) and Buffalo (80.6 down 14.2). Confidence declined in every region.

Thirty-seven percent, up from 30 percent, of CEO’s now say that business conditions have worsened in New York over the last half of 2012 while 21 percent feel as though the economy has improved recently. Today’s assessment is weaker than it has been for two years and similar to how CEO’s scored at this time in 2010. For the first time in six years, CEO sentiment is lower than the comparable Index of Consumer Sentiment which now shows citizens of New York to be more optimistic about the economy than are CEO’s of private for profit companies.

Revenues, Profits and Labor Force

Expectations for revenues and profits through 2013 are down compared to last year’s among CEO’s. CEO’s plans to acquire new fixed assets and to increase their workforces are virtually unchanged from last year. Fifty percent (52% a year ago) plan to purchase equipment and machines and 22 percent (23% a year ago) intend to hire. Layoffs may increase this year as 15 percent (up from 12%) intend to decrease the size of their workforce.

Thirty-six percent of CEO’s anticipate increasing revenues during 2013 as compared to 40 percent last year, and 29 percent expect less revenue this year up from 20 percent having that expectation last year. Twenty-seven percent anticipate increasing profitability this year (down from 30%) while a 39 percent (up from 31%), expect to experience declining profitability.

Amidst lessened confidence and diminished expectations for revenues and profits, fixed asset acquisition plans remain encouragingly high at 50 percent. Of those that do anticipate asset acquisitions, 56 percent plan to use internally generated funds as opposed to borrowing from a financial institution (35% up from 32%).

Twenty-two percent of business leaders expect to at least moderately increase their workforce in 2013 down only slightly from 23 percent a year ago. While 61 percent intend to have their workforce remain the same, 15 percent, up from 12 percent last year, plan on decreasing their labor force. Five years ago, at the time when most agree the recession was just beginning, 36 percent of CEO’s said they planned to increase their workforce as compared to only 6 percent anticipating reductions.

Concentrations, Challenges and Attitudes towards Government

As New York’s CEO’s work to succeed in an economy that is slow to recover, they are split between those that focus on market and demand growth (36%) and those that focus on cost reduction as a strategy (36%). Optimistic companies tend to target growing sales while the more pessimistic companies still primarily look to cost cuts as a business strategy. A small but increasing percentage (13% up from 8% the last two years) plan price increases this year.

Nearly 80 percent of CEO’s cite health care costs as a challenging concern while 70 percent worry about governmental regulation and 68 percent note the negative impact of taxation. Adverse economic conditions continues to concern two-thirds of New York’s CEO’s.

Forty percent of CEO’s call on the Governor and Legislature to cut spending as their top focus. While CEO’s continue to lack confidence in the ability of New York’s government to improve business conditions, their faith in New York’s government has increased. But their confidence in the federal government remains extremely low. CEO’s strongly support domestic energy development, a balanced budget amendment, reducing corporate income tax rates, repealing the health care legislation and capping annual increases in federal regulatory spending at $0.